Market-based approaches

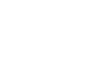

Introduction to carbon markets

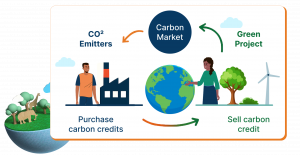

The carbon markets can be divided into two broad categories – voluntary carbon markets and the compliance carbon markets or “Article 6”, named after Article 6 of the Paris Agreement.

Carbon Markets :

Voluntary carbon markets are driven by private sector actors who seek to buy voluntary emission reductions to meet voluntary commitments to offset their own emissions, often with the goal of reaching net-zero. Initiatives such as the Task Force for Climate-related Financial Disclosure (TCFD) and the Glasgow Financial Alliance on Net-Zero (GFANZ) are driving demand for voluntary emission reductions. The Carbon Offset and Reduction Scheme for International Airlines, CORSIA also accepts some types of voluntary emission reductions and is expected to be a major source of demand.

Compliance vs Voluntary

The compliance markets build on the experience of the Kyoto Protocol and the Clean Development Mechanism (CDM) but it is very important to appreciate that since the Paris Agreement requires all parties to submit nationally determined contributions, emission reductions have value in all countries.

Article 6 of the Paris Agreement allows for trading of Internationally Transferable Mitigation Outcomes (ITMOs) under Article 6.2 and Mitigation Outcomes under article 6.4.

ITMOs are traded on the basis of a bilateral agreement between two Parties and must be accompanied by a Corresponding Adjustment whereby the number of ITMOs transferred out of a country must be reflected as emissions in their national inventory whilst the number of ITMOs imported into a country, and utilized for compliance or other purposes, may be deducted from the importing country’s national inventory.

Article 6.4 also known as the Paris Agreement Crediting Mechanism, is effectively a continuation of the Kyoto Protocol’s flexible mechanisms – the Clean Development Mechanism and Joint Implementation. It is a project-based mechanism where private sector actors may, with the host country’s approval, implement projects and generate Mitigation Outcomes which are approved by the UN’s Article 6.4 Supervisory Body. These Mitigation Outcomes may also benefit from a Corresponding Adjustment, in which case they can be sold for compliance with NDC commitments, or they can remain as voluntary units outside the formal accounting process under the Paris Agreement.

Opportunities for African countries

The African Development Bank and partners have done extensive work on developing the concept of adaptation benefits and co-benefits. Some climate actions, such as sustainable agricultural land use, sustainable forest and agroforestry management, access to clean energy, including clean cooking, and access to clean water and sanitation deliver significant adaptation benefits with mitigation co-benefits. Our work suggests that financing such technologies and solutions as adaptation projects is possible if the driving factor behind the project is response to a climate hazard and can be considerably more efficient and effective than relying on carbon markets. Adaptation is still underfunded and complementing carbon markets with a range of non-market approaches for adaptation is currently a missed opportunity.

Related News

Africa delivers the first mechanism for international cooperation on climate change adaptation under the Paris Agreement

The African Development Bank’s Adaptation Benefits Mechanism (ABM), piloted across Africa since 2019, has become the first non-market approach registered...

African Development Bank wins prestigious award for its innovative Adaptation Benefits Mechanism

The African Development Bank (AfDB) has been awarded the Special Jury Grand Prix at the inaugural Finance Your Cities (FYC) Innovation Awards...

As warming worsens floods, snake-like mobile dams could protect Africans

GLASGOW, Nov 12 (Thomson Reuters Foundation) – Mobile “slamdam” flood barriers that look like huge blue snakes are among promising...

Resilience and adaptation to climate change 1/2

Part 1 – Financing adaptation and resilience to climate change: why it matters After two hurricanes hit Honduras in as...

Resilience and adaptation to climate change 2/2

Part 2 – Financing adaptation and resilience to climate change: what do we need to do? In Part 1 of this blog,...