Non-market approaches

Non-market approaches can be applied to projects generating hard to measure emissions reductions or mitigation high global-warming potential (GWP) greenhouse gases. Both of these categories have the ability to undermine and destabilize carbon markets and the Bank’s own work on non-market mechanisms suggests that taking these categories of sources out of the carbon markets will help to deliver a better-quality market.

The Concept

The financing of biodiversity conservation has not yet benefited from the explosion of creativity that has characterized climate finance, with the rise of “Green Bonds”. Yet maintaining biodiversity is essential at multiple levels, including securing the livelihoods of many people, especially in areas that will be most severely affected by climate change. As such, national park networks play an essential role in halting the loss of biodiversity. They make it possible to limit, or even reverse, the rates of deforestation. This contributes to better resilience to climate change (adaptation) as well as the emergence of carbon sinks (mitigation).

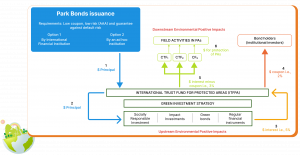

The Park Bonds project is an international initiative. They were introduced in 2014 in an article entitled “Park Bonds, a new mechanism to secure the long-term financing of Protected Area networks”. The African Development Bank is co-financing a pre-feasibility study for issueing Park Bonds for West African Conservation Trust Funds (CTFs). Park Bonds for sustainable management of natural parks were designed to improve the financing of biodiversity conservation by targeting an increased participation of the financial markets and the private sector in climate change mitigation and nature-based adaptation activities on the intersection with nature preservation.

Opportunities for African countries

African countries harbor endemic species, rich biodiversity and unique ecosystems that provide important environmental services to the local and global population. For many years, protected areas have been established to maintain these important ecosystems. Protected areas maintain essential ecosystem services which can increase the resilience of livelihoods and reduce their vulnerability to climate hazards. They could also generate significant income through ecotourism, etc. Biodiversity Conservation Trust Funds (CTFs) have proven to be an excellent tool for channeling finance, but they are still under-capitalized to fully meet their conservation and climate change adaptation goals.

Park Bonds could become a new funding mechanism to diversify the sources of funding for CTFs. They will generate a new flow of funding for CTFs from institutional investors. The expected financial income will be shared between bondholders and participating CTFs, which are considered the beneficiaries. In order to safeguard the integrity of the Park Bonds, CFTs are expected to be transparent in the use of Park Bonds incomes and carry out robust financial audits and evaluations.

According to estimates, in a “pilot” version, the Park Bonds could generate 1 million euros per year and per participating CTF, over a period of 10 years.

Related News

Africa delivers the first mechanism for international cooperation on climate change adaptation under the Paris Agreement

The African Development Bank’s Adaptation Benefits Mechanism (ABM), piloted across Africa since 2019, has become the first non-market approach registered...

African Development Bank wins prestigious award for its innovative Adaptation Benefits Mechanism

The African Development Bank (AfDB) has been awarded the Special Jury Grand Prix at the inaugural Finance Your Cities (FYC) Innovation Awards...

As warming worsens floods, snake-like mobile dams could protect Africans

GLASGOW, Nov 12 (Thomson Reuters Foundation) – Mobile “slamdam” flood barriers that look like huge blue snakes are among promising...

Resilience and adaptation to climate change 1/2

Part 1 – Financing adaptation and resilience to climate change: why it matters After two hurricanes hit Honduras in as...

Resilience and adaptation to climate change 2/2

Part 2 – Financing adaptation and resilience to climate change: what do we need to do? In Part 1 of this blog,...